2023 is coming to an end, and farmers are about to count their year-end profits. If you want to increase your income this year by tax deductions, it would be a good idea to focus on repair and maintenance expenses/capital expenditures.

If you don’t know this way yet, you may be overpaying in taxes. As you know, the IRS has many regulations that restrict you. In this article, we would like to share with you the cost of purchasing farm equipment accessories as a method. Without further ado, let’s get into the topic.

What are tax deductions?

Tax deductions, also known as tax write-offs, are the process by which qualified expenses can be deducted from business income when filing business taxes.

What are expenses eligible for tax deductions?

This means that expenses incurred for business purposes can be included in the tax refund. For example, if you wholesale aftermarket parts for your tractors, which are used for business operations, then this wholesale expense is eligible for a tax deduction. However, you must refer to local regulations and standards specifically. It is recommended to ask your professional accountant or tax advisor.

Now that we understand these definitions, let’s turn the topic to replacement parts.

Why replacement parts and aftermarket parts are a good choice?

Farmers need to use a variety of important agricultural equipment in their daily operations, such as tractors, farming equipment, seeders, etc. To ensure the normal operation and productivity of the equipment, farmers need to perform regular repairs and maintenance. In the process, purchasing repair parts has become an unavoidable expense.

What parts do U.S. farmers buy for their equipment?

One of the most purchased farm equipment parts by American farmers during the winter is those related to repairing and maintaining farm machinery. Winter is the off-season for agriculture, and farmers usually use this time to inspect, repair, and update equipment to ensure that the equipment can operate normally in the next planting season. Therefore, this is also a good tax refund opportunity. Most of them purchase the following parts (mainly):

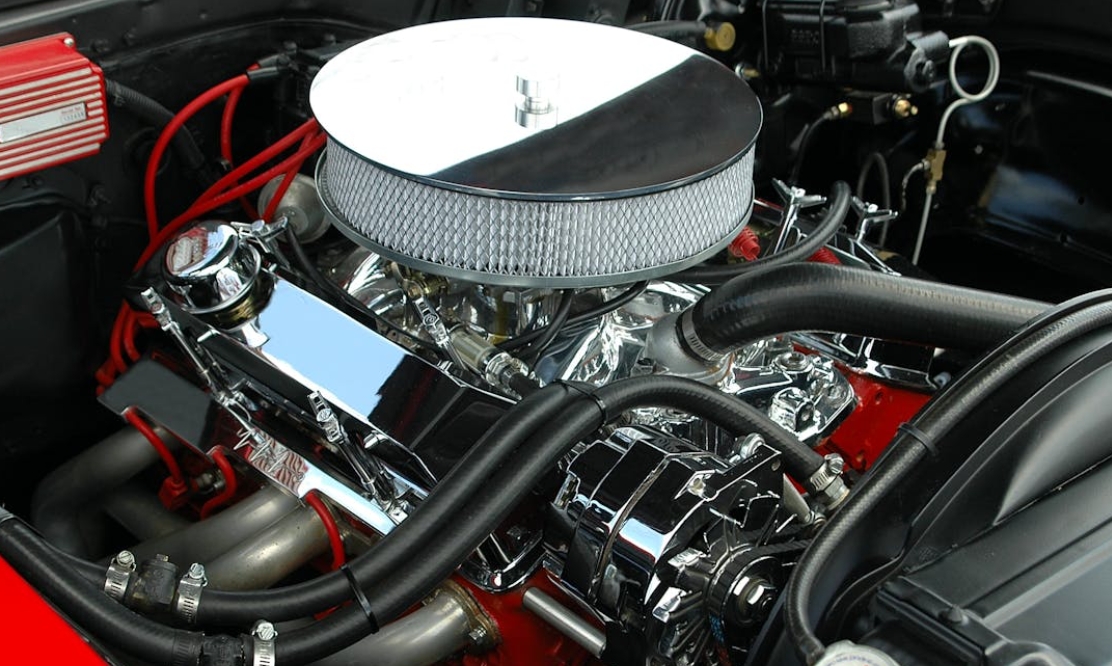

Engine and power transmission parts

They can ensure the normal operation and power output of agricultural machinery, including engine spare parts, transmission system parts, such as crankshafts, pistons, cylinder liners, connecting rods, transmission belts, etc.

Tires and tracks on agricultural machinery

They can become worn or damaged after prolonged use. Purchase new tires, tracks and related tire pads, chains, etc. to ensure the normal driving and traction capabilities of the machinery in the farmland.

Hydraulic system parts

They include hydraulic pumps, valves, seals, etc. Farmers may purchase these parts to ensure the proper functioning of hydraulic systems.

There are also other parts that farmers need to keep their farm business running smoothly.

How do get tax deductions for farmers?

Farmers can treat the cost of purchasing new service parts for one year’s worth of farm equipment as a write-off expense. Because these expenses are directly related to the agricultural business, it is used to maintain and repair agricultural equipment to ensure its normal operation and productivity.

Tax authorities consider repair parts purchase costs as repair and maintenance expenses for tax purposes. Farmers can depreciate these expenses over the lifespan of the equipment and write them off in accordance with tax laws. These expenses have the potential to qualify as deductible expenses that reduce taxable income, thus lowering tax liability.

Conclusion

It is a good way to get the tax deduction, you can ask your accountant if you are interested. Your accountant will help you handle the tax aspects of purchasing replacement parts. By the way, if you are planning to buy or wholesale aftermarket parts, you can contact us directly. FridayParts offers a wide range of parts for your agricultural equipment and you can get these compatible parts at competitive prices. I think these coupons will help you:

Black Friday Deals and Coupons

Finally, I hope you get a tax deduction.

Reference: https://www.youtube.com/watch?v=1AakpcFcLjU

very good jon bro. it helped me a lot thx

Thank you! I’m glad I could help.

very good jon mate. very useful to me.

I have learn several good stuff here. Definitely value bookmarking for revisiting.

I wonder how a lot attempt you put to make the sort of wonderful informative site.